Tex-Isle Steel Market Update, December 2020

Steel Market Update

In a continuation of last month’s update, the entire steel market has continued its torrential move higher. Across the globe there are similar stories, with the takeaway being that this is a supply shortage. In an effort to shore up balance sheets consumers of steel allowed month to month supply chains to collapse, while steel producers deferred maintenance and idled any production they could.

While the economic recovery has restarted demand in earnest, supply chains have taken longer to re-start. This has resulted in a complete mismatch of available production to current demand. To highlight this point, the utilization rate of US steel mills has remained flat, around 70%-72%, since October while HRC prices have jumped almost $200 per ton. Mills, for whatever reason, have not been able to keep up with demand.

Consumers are being forced into a position to purchase steel to fulfill orders, regardless of price, driving the upward pricing pressure. Domestic HRC has doubled since August, scrap is up 44%, and iron ore is up 35%. The January futures market for coil, scrap, and iron ore all indicate that the dramatic increase has not finished.

We do think that at some point in the first quarter the market will find some equilibrium as a result of increasing steel production and a cessation of necessity purchasing. At that point we expect steel pricing to come correct, although not to the levels seen over the summer of 2020.

OCTG & Line Pipe Market Update

OCTG and Line Pipe have been somewhat from the mayhem seen in the steel markets, but we believe that situation is due to change. Given the quantity of inventory on the ground, and tepid demand, the energy industry has simply worked off older inventories and existing orders.

We are now at the time that the steel price increases which started in October will bleed over to the tubular side. Demand has recovered over 30% in the past two months alone. Without a dramatic change in shipments from domestic mills or imports, the months' worth of consumption in inventory will be cut in half by March.

The dumping of inventory that is typically seen at this time of year is occurring, but by January a different situation will emerge. Drilling programs or line pipe projects which have not already locked in pricing can expect to see a backwardation effect pushing mills or distributors to set pricing at their cost of new production or replacement cost.

Given that domestic steel mills have already closed order books for January, we expect many pipe producers will follow. This will force what have been extremely depressed prices higher in the first half of the year before levelling off.

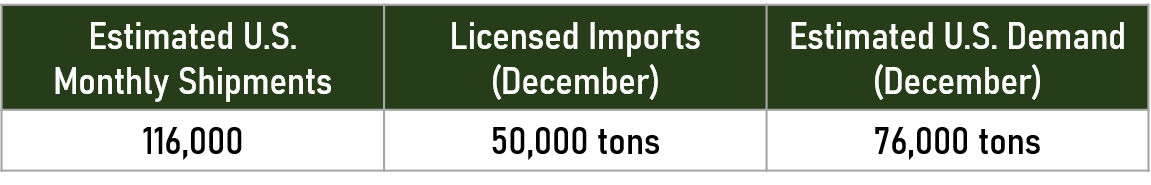

LINE PIPE SHIPMENTS

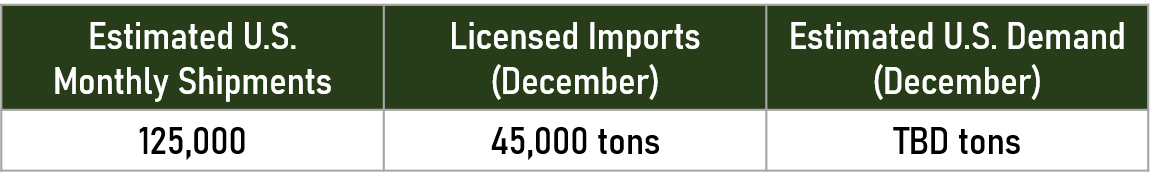

OCTG SHIPMENTS

Tex-Isle Service Spotlight: Distribution

Tex-Isle has been a leading supplier of line pipe and OCTG to the Oil and Gas industry for the past 60 years. Our Asset Based Distribution® model includes manufacturing facilities, an integrated quality assurance program, and a data-driven supply chain.

An unmatched portfolio of manufacturing capabilities, distribution services, and engineering expertise. Tex-Isle’s vertical integration provides customers the highest quality product at the most competitive cost. We offer a broad range of sizes, grades, connections, and coatings to meet any operational requirements.

Tex-Isle's strategic variety of services to meet the needs of our customers. We offer and operate an internal coating facility in George West, TX, and a Heat Treating and Threading facility in Robstown, TX.

By accepting you will be accessing a service provided by a third-party external to https://www.texisle.com/